Finance - Credit Check Automation

A finance company used a mix of the latest digital tech and a human touch to bring a different approach to small businesses lending.

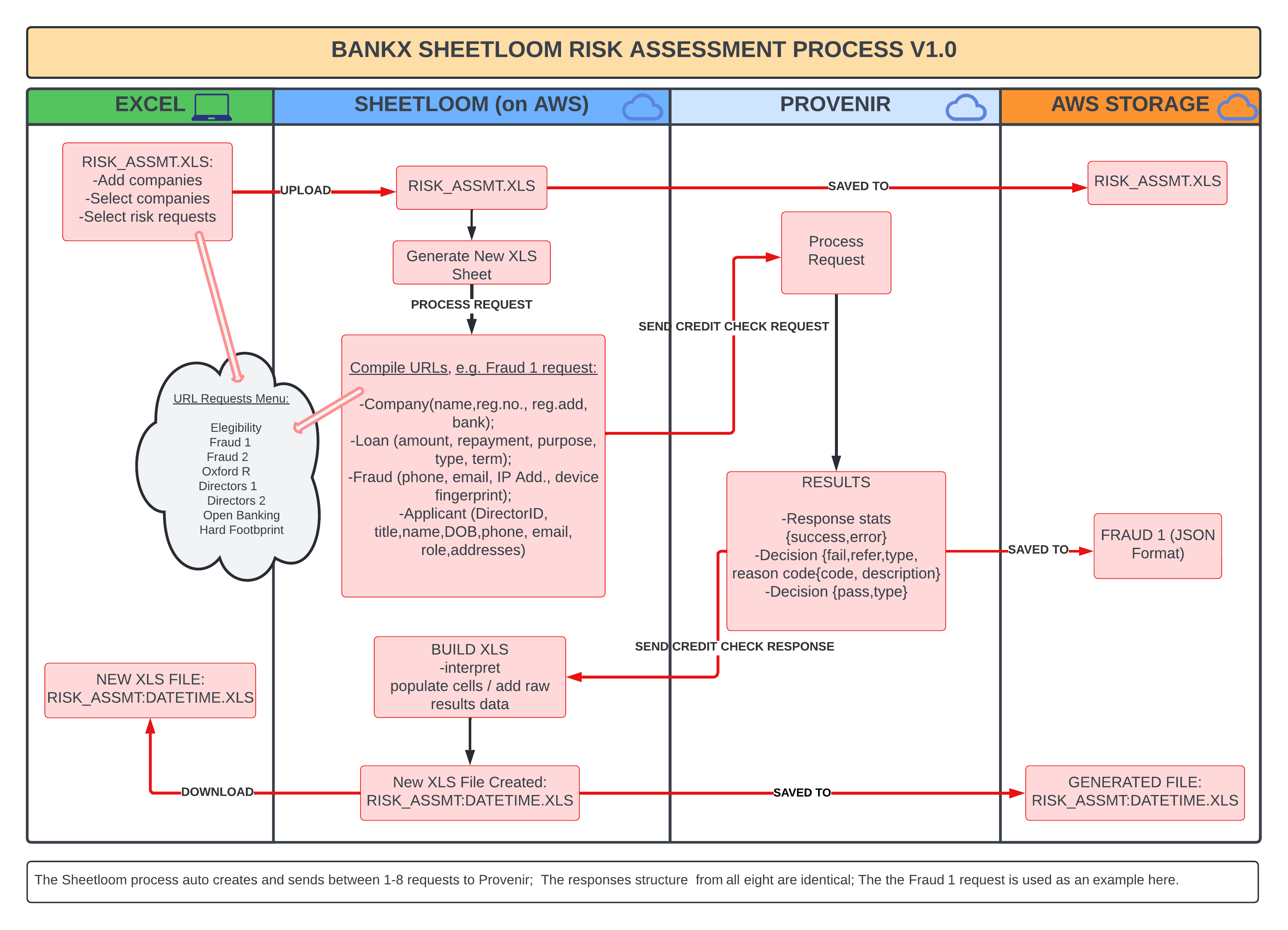

A crucial part of the loan review process required the company to credit score each applicant. Testing of the credit score process proved very time consuming using traditional methods. The finance company would manually; select applicants, collect individual responses and then consolidate results from a credit checking service.

The Sheetloom service was quickly installed and maintained directly on the customers environment using AWS CloudFormation. The company CFO was then able credit check each applicant automatically by simply uploading an excel spreadsheet with their details. Sheetloom orchestrated multiple API calls to the Provenir credit service, returning all responses to the spreadsheet decision model.

Using Sheetloom to check credit scores resulted in a significant cost and time saving for the finance company across multiple applicants. This saving amounted to 72 hours of the CFO's time each month.